Call us :+61 3 8678 0200

Our sustainable investment philosophy

Lighthouse believes that returns for investors in real assets will be maximised over the long term on the basis that environmental, social and economic utility is sustained and underpinned by a robust and appropriate governance regime.

Our approach to sustainability and our commitment to responsible investment

Sustainability is the ability to maintain a given level of activity. Lighthouse relates this capacity to its investment and asset management activities by strongly believing in:

Environmental sensitivity

Humanity is challenged by resource depletion and climate change. For the investments we make to be sustainable, they must efficiently utilise our scarce resources and care for the environment.

Social responsibility

Infrastructure assets provide essential services to communities they serve and inform and contribute to the public good. For their activities to be sustainable, investors and asset managers must provide access to essential services in a fair and an efficient manner.

Economic productivity

For any activity to be sustainable it must be productive. Investment activity must provide mutual benefits to users and to owners.

Environmental, social and economic utility drive investment returns which are achieved through the alignment of these factors. We ethically manage and are responsible stewards of our assets for the long-term performance of our clients. Sustainable value can be created over longer term periods through the active management of opportunities and the control and mitigation of risks over the life cycle of the assets.

Our commitment to addressing climate change

Addressing the urgent challenge of climate change and decarbonising our economy are more pressing now than ever. Lighthouse engages a specialist climate change and sustainability consultant to help measure both our investment portfolio and corporate carbon footprints to align to the UN Paris Agreement and contribute to the UN Sustainable Development Goals (SDGs) including goals for affordable, clean energy and climate action. We have most recently identified our scope 1, 2 and 3 emissions for the financial year 2022.

Lighthouse is committed to the measurement of GHG emissions across both our business and portfolio asset operations, in line with the Partnership for Carbon Accounting Financials (PCAF)*. We have most recently identified our scope 1, 2 and 3 emissions for the financial year ended 30 June 2022 (FY2022) and we are now in the process of measuring financial year ended 30 June 2023 (FY2023).

Furthermore, Lighthouse is committed to achieving ‘carbon neutrality’ in its business operations in the short term, defined as removing carbon from the atmosphere and permanently storing it to counterbalance the impact of emissions that remain unabated. Following this commitment we are pleased to report that Lighthouse Infrastructure’s business operations have been officially certified as carbon neutral for FY2022. We will be aiming to achieve the same carbon neutrality certification in relation to our business operations for the FY2023.

* PCAF is a global partnership of financial institutions that work together to develop and implement a harmonised approach to assess and disclose the greenhouse gas (GHG) emissions associated with their loans and investments.

In recognising the complex nature of implementing a net zero carbon strategy at a portfolio level, we continue to investigate the pathway to net-zero, defined as reducing scope 1, 2, and 3 emissions to zero or to a residual level aligned with a 1.5˚C scenario and neutralising any residual emissions using carbon credits or other carbon removal measures.

To this end, we have established the following objectives:

- In FY21, we commenced the measurement of GHG emissions of our investment portfolios in line with the Partnership for Carbon Accounting Financials (PCAF) framework and have been reporting on our climate impact since that time.

- We are committed to the development of a net zero pathway to align our investment activities with the Paris Agreement in accordance with the Science Based Targets Initiative’s (SBTi) guidance for the financial sector and the SBTi Net Zero Standard.

- We will be prioritising reductions in our own value chain over an offset strategy, and intend to identify and implement strategies using existing and emerging technologies and techniques to reduce emissions. Potential strategies include investing in the addition of further renewable energy generation capacity at our solar sites, developing energy efficiency initiatives for our specialist disability accommodation and Key Worker Housing portfolios and generating land based carbon removals where feasible.

The Paris Agreement

The Paris Agreement is a legally binding international treaty on climate change. It was adopted by 196 parties in Paris, on 12 December 2015 and entered into force on 4 November 2016. Its goal is to limit global warming to well below 2, preferably to 1.5 degrees Celsius, compared to pre-industrial levels.

To achieve this long-term temperature goal, countries aim to reach global peaking of greenhouse gas emissions as soon as possible to achieve a climate neutral world by mid-century.

The Paris Agreement is a landmark in the multilateral climate change process because, for the first time, a binding agreement brings all nations into a common cause to undertake ambitious efforts to combat climate change and adapt to its effects.

Source: UN Climate Change, The Paris Agreement

Our sustainable development goals integration journey

The United Nations (UN) Sustainable Development Goals (SDGs) are a collection of 17 interlinked global goals designed to be a “blueprint to achieve a better and more sustainable future for all”.

The SDGs were set in 2015 by the United Nations General Assembly and are intended to be achieved by the year 2030. Whilst many of the specific targets underlying the goals relate specifically to improving conditions in developing countries, a significant number of the targets have application within developed nations and the UN is encouraging not only governments, but also the corporate and social services sectors to contribute to the goals at a localised level. Included alongside are the 17 interlinked global UN SDGs.

Lighthouse has increasingly considered the UN SDGs to be an effective framework to help guide our investment selection process given the strong link that exists between many of the UN SDGs, our sustainable investment philosophy and the social and environmental outcomes which are ultimately generated by the operation and usage of the infrastructure assets we are responsible for managing on behalf of our investors.

In order to embark upon a more formal UN SDG business and investment operation integration model Lighthouse employees completed a fit for purpose, UN accredited study and training program in 2020. Lighthouse engaged with representatives from CIFAL Newcastle at the University of Newcastle, which offers United Nations Institute for Training and Research (UNITAR) accredited training activities about the implementation of SDGs.

SDG selection and integration

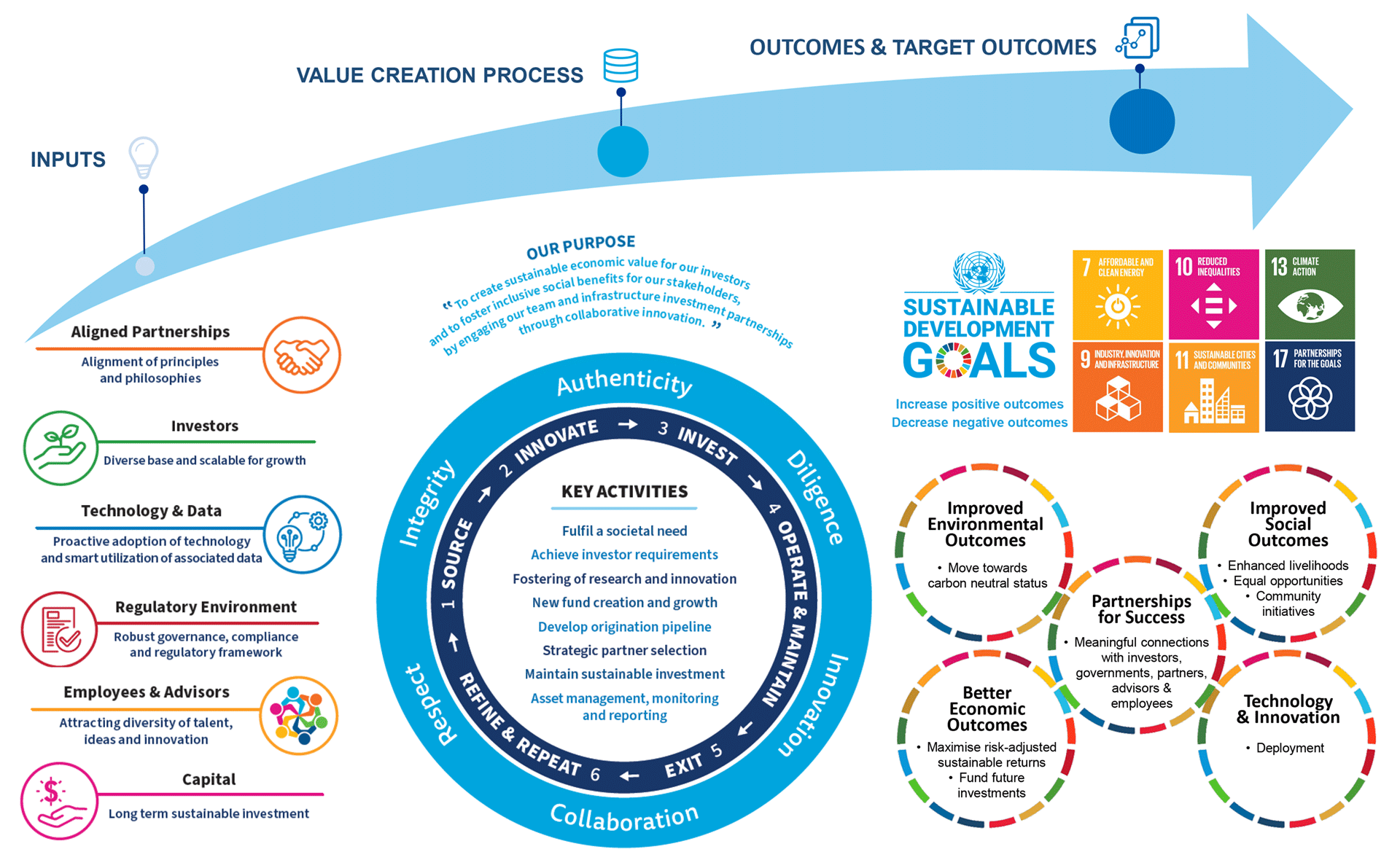

As an organisation we undertook a series of discovery workshops and associated activities to map the SDGs into the Value Chain we developed by considering how our core competencies, technologies and investment funds currently and potentially can contribute to the SDGs.

As part of the process, we established five key areas where we consider our capabilities and actual and potential outputs to be well-placed to create value for multiple stakeholders being our investors, employees, partners, those who use the services created by our infrastructure assets and those who are affected by their operation.

The five key areas we have identified are:

1. Better economic outcomes

For any activity to be sustainable it must be productive. Investment activity must provide mutual benefits to users and to owners. Careful asset selection with aligned ESG principles, embedding further ESG integration and reporting, can produce a lower cost of capital for assets we invest in, creating additional value for our investors.

2. Partnerships for success

Development and fostering of meaningful relationships with investors, partners, advisors, policy makers and employees will be required to deliver genuinely sustainable outcomes through the provision of essential services on real assets.

3. Technology and innovation

We value innovation, encouraging and supporting our team members to complete research, think creatively and devise new investment and support solutions which generate financial value for our investors. We aim to use technology to optimise the performance of existing and new assets to increase gains of financial returns, asset efficiency, safety, security and sustainability performance.

4. Improved environmental outcomes

Humanity is challenged by resource depletion and climate change. For the investments we make to be sustainable, they must efficiently utilise our scarce resources and care for the environment. This includes working to drive down greenhouse gas emissions across our investment portfolios and at a corporate level.

5. Improved social outcomes

Infrastructure assets provide essential services to communities they serve and inform and contribute to the public good. For their activities to be sustainable, investors and asset managers must provide access to essential services in a fair and an efficient manner. We look to support our service providers, other key relationships, and the communities where we invest.

The next and ongoing step in our SDG journey for each of these five key outputs will be to identify specific areas of improvement focus which we can measure and report progress against for each year going forward. As an organisation, we are energised by our ability and potential to create positive financial, social and environmental outcomes for our stakeholders and look forward to reporting these activities to our investors going forward.

Lighthouse Infrastructure’s Value Chain

After the completion of the UNITAR training course, the Lighthouse team developed the Lighthouse Infrastructure Value Chain. Our Value Chain illustrates the inputs into our business, the transformation and value creation processes we undertake, the outputs and outcomes we ultimately deliver and those we aspire to achieve.

Memberships and supported initiatives

Lighthouse is committed to sustainable investment and supports the following initiatives:

United Nations Principles for Responsible Investment (UNPRI)

Lighthouse is a signatory to the UNPRI. The six Principles for Responsible Investment are a voluntary and an aspirational set of investment principles that offer a range of possible actions for incorporating ESG issues into investment practices. In implementing them, signatories contribute to developing a more sustainable global financial system.

Investor Group for Climate Change (IGCC)

Lighthouse is a member of the IGCC and has been an active contributor to a number of initiatives over the years including participation on a number of working sub-committees.

UN Sustainable Development Goals / UNITAR training program – University of Newcastle

During the FY21, Lighthouse completed a training program with the University of Newcastle to examine the integration of the (UN) Sustainable Development Goals (SDGs) into the investment and management activities of Lighthouse investment funds. The training program is accredited by the UN Institute for Training and Research (UNITAR).

Lighthouse currently references the UN SDGs to help guide its investment selection process and is actively working to further integrate the goals into its broader fund investment and management processes.

Pension Governance and Innovation Forum & “Infrastructure Matters” initiative – Harvard Alumni Entrepreneurs (HAE)

In 2019, Lighthouse created the Infrastructure Matters initiative as part of the Harvard Alumni Entrepreneurs, a cross-faculty group of the University Alumni. The purpose of the initiative is to advance work on pensions and capital stewardship, on the nature of infrastructure, on the relevance of infrastructure-related enterprises as objects of investment by pension funds and other investors, including Islamic investors, on the roles and responsibilities of government and the private sector in this connection, and on the impact on and import of any such investments on the lives and livelihoods of those affected.

The Harvard Alumni Entrepreneurs Pension Governance and Innovation Forum was formed in 2021 to apprise, to focus, to educate workers, scholars, policymakers, researchers, and pension fund, infrastructure investment, and other practitioners on issues such as fiduciary duty and pension fund governance, management, and investment, especially as they bear upon plan members gaining financial security in retirement.

Clean Energy Investor Group (CEIG)

Lighthouse is a founding member of the CEIG. Across regulation and policy arenas the CEIG initiates, investigates, and responds to consultations and national electricity rule changes that impact institutional investors’ interests in the renewable energy sector.

You can access a copy of the Lighthouse Infrastructure Environmental, Social and Governance (ESG) policy here.

Case Study

Lighthouse Secures Australia’s First Social Loan for Specialist Disability Accommodation

In October 2023, Lighthouse Infrastructure (Lighthouse) secured Australia’s first social loan dedicated to funding Specialist Disability Accommodation (SDA). The value of the social loan exceeded AUD $130 million and was issued in equal part by Commonwealth Bank of Australia (CBA) and National Australia Bank (NAB).

The loan enables the expansion of SDA assets within Lighthouse’s Australian Disability Accommodation Projects Trust 2 Fund (ADAPT2), an evergreen fund exclusively focused on long-term investments in Australian SDA. Backed by capital provided by investor Victorian Funds Management Corporation (VFMC), the Fund encompasses both the development and construction of new SDA assets and the acquisition of operational SDA properties that align with the fund’s investment criteria. Lighthouse is one of the largest institutional investors in Australian SDA assets.

Social-labelled loans are a type of sustainable finance that’s used to fund projects and activities that address a social issue or achieve positive social outcomes for certain populations, particularly underserved, marginalised and vulnerable groups. Social finance is a nascent market in Australia, and one that Lighthouse is helping to develop with this innovative transaction that applied the Social label to SDA. At the time this social loan was announced (October 2023), only four social loans had been issued in total in Australia. As awareness of social investments grows amongst institutional investors, other formats for financing SDA including social bonds may follow in the future, making Lighthouse’s debut in the social loan market an important step in the evolution of this asset class

In establishing the social loan, CBA and NAB served as Joint Sustainability Coordinators, collaborating with Lighthouse to develop its Sustainable Financing Framework. This comprehensive framework articulates Lighthouse’s approach to undertaking and managing its social loans, while detailing the eligible social assets, projects and target populations set to benefit from the proceeds. Lighthouse sought to adhere to market best practice by aligning its framework to the Social Loan Principles issued by the Asia Pacific Loan Market Association (APLMA).

Andrew Hinchcliff, Group Executive, Institutional Banking & Markets at Commonwealth Bank, interviewed James Hooper, Lighthouse Managing Director, in relation this social loan.

You can watch the interview between James Hooper and Andrew Hinchcliff here.